Last time we looked at the new Market Analysis 2025 - Cambodia Condominium Report from Realestate.com.kh and focused on trend changes and development in both sales and rental market demographics of key buyer and renter groups in Phnom Penh.

With this detailed report, you get an honest, data-backed insight which can empower buyers, sellers, and developers to make informed choices in the Cambodian real estate markets, and specifically when it comes to condos.

It should be noted that the terms "condo" and "apartment" are often used interchangeably in Cambodia.

Tom O’Sullivan, CEO of realestate.com.kh, said, “Sales activity in the condo market is strong, particularly in well-built, well-located developments—a clear sign of a 'flight to quality, ' and although he does say the opportunities are real, you still need to consider the risks.

Phnom Penh serves as the country’s political and economic centre and sees the most real estate activity, with the largest number of condos being added to the capital.

Siem Reap is home to the world-renowned Angkor Wat temple and also has its appeal, while along the southern coast, Sihanoukville offers a gateway to Cambodia’s tropical islands and remains a vital part of Cambodia’s ongoing growth. 5% of total transactions were in Siem Reap, with 2% taking place in Sihanoukville.

Why Sihanoukville Is Cambodia’s Top Destination for Infrastructure Investment

What is Appealing to Cambodian Condo Buyers?

Sotha Vatey, Sales Director at realestate.com.kh, explained that the demands for quality condos mean “there is also a strong emphasis on livability and lifestyle. Developers are expanding their amenities beyond the standard pool and gym, incorporating co-working spaces, libraries, gardens, rock climbing walls, golf simulators, cafés, restaurants, and more.”

In terms of the preferences shown among buyers of condos in Cambodia, and in Phnom Penh in particular, 1-bedroom units have dominated buyer preferences and remain the most popular choice among investors due to their affordability, ease of rental, and strong appeal to singles and couples.

- One-bedroom condos contributed up to 61% of the total unit mix

- Two-bedroom units contributed 20.5%

- Studio rooms contributed 10.1%

- Three-bedroom units contributed 8.4%

In the Cambodian capital, it was also noted that there is a lack of supply of centrally located 3-bedroom units for rent, which presents a growing opportunity as demand rises.

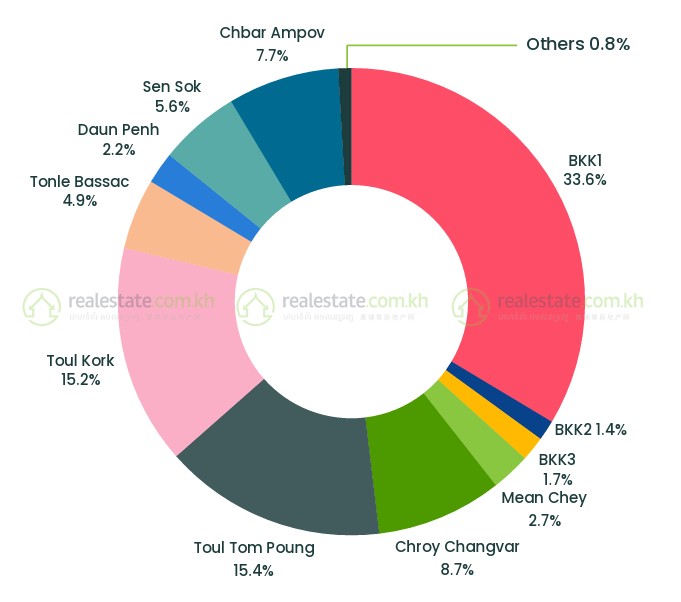

The report’s data suggest that there is a strong preference for central Phnom Penh locations to buy condos, with BKK1 holding onto its most desirable location yet again, followed by Toul Tom Poung.

Top Four Most Popular Areas To Buy Property in Phnom Penh

Top 5 Areas To Buy in Phnom Penh

- Boeung Keng Kang 1 (33.6 %) average price/sqm US $2,000

BKK1 is seen as a safe area with proven returns from a premium neighbourhood, and investors are drawn to its consistent demand, high rental yields, and low vacancy rates. The central location ensures strong resale value and makes it desirable for investors seeking stability and capital appreciation. - TTP (15.5%) average price/sqm US $1,200

The area known as Russian Market remains fast-growing and a lifestyle hub with a strong local-foreigner blend. TTP has a vibrant culture and offers affordability, thus attracting buyers priced out of BKK1 and Tonle Bassac. - Toul Kork (15.2%) average price/sqm US $1,450

The area is home to the growing middle class as well as being favoured by affluent Cambodian families, while the condo options make it more accessible to middle-class and younger buyers. The location offers easy access to the CBD the pricing of the condos here appeals to those working in the city centre. - Chroy Changvar (8.7%) average price/sqm US $1,700

Offering riverside living with rising infrastructure-led value, the area’s improved connectivity, as well as relatively peaceful riverside living and open spaces, has seen its popularity grow as it has long-term growth potential. - Chbar Ampov (7.7%) average price/sqm US $1,600

The district is rapidly developing and more affordable than the other areas, with prices generally below the city average. Located in the southeast of Phnom Penh, Chbar Ampov is connected with newer transport links, which also make it more convenient to live in.

In terms of pricing in Phnom Penh, the average price per square meter is US $1,800 gross, with Tonle Bassac demanding the highest prices of an average of US $2,500.

Boeung Keng Kang Remains a Firm Favourite In Phnom Penh

What Are Phnom Penh Condo Renters Looking For?

In terms of what renters of condos desire in Phnom Penh, 1-bedroom units dominate rental demand in the same way 1-bedroom condos lead sales. In terms of preferences and average rental prices per month in the capital:

- One-bedroom condos 72% - US $350

- Two-bedroom units contributed 18% US $500

- Three-bedroom units contributed 5% US $900

- Studio rooms contributed 5% US $1,322

Studio units make up just 5% of long-term rental demand but perform better in the short-term market.

Phnom Penh's Top Condo Projects Ready for Handover in 2025!

Top 5 Areas To Rent in Phnom Penh

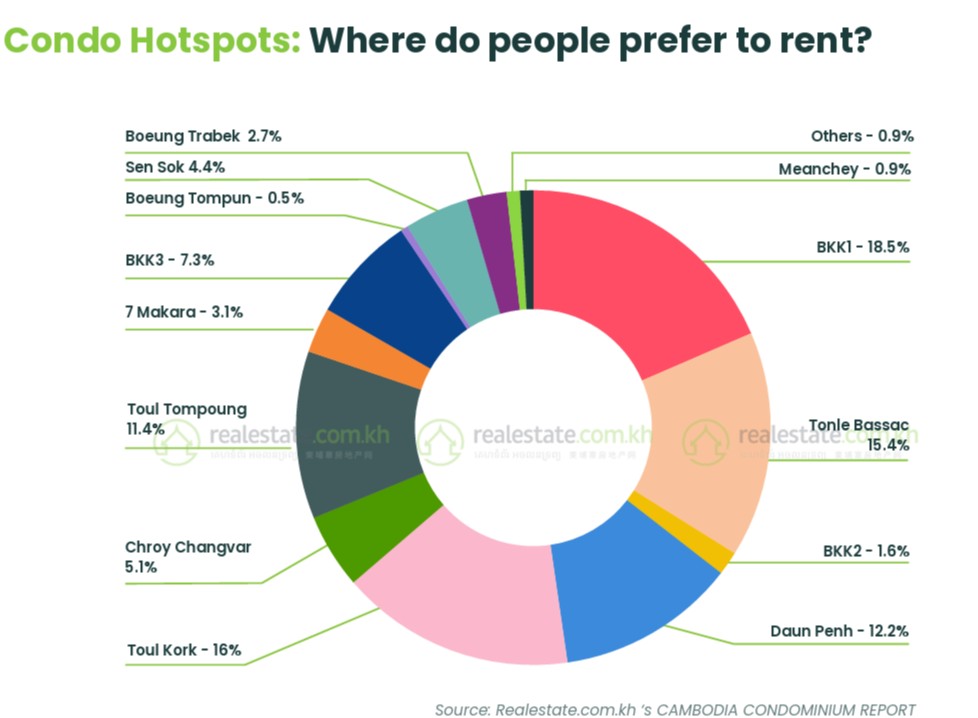

The most popular areas to rent show some stark differences from where buyers are looking to invest in Phnom Penh.

- BKK1 18.5%

- Toul Kork 16%

- Tonle Bassac 15.4%

- Daun Penh 12.2%

- TTP 11.4%

The full range of average rental options for unit types in each area. It is worth noting that BKK1 (Boeung Keng Kang 1), which commands the most premium rents in the city, one-bedrooms average US $800, two-bedrooms are US $1,450, and three-bedrooms average US $2,550. In Tonle Bassac and Toul Tom Poung (Russian Market), one-bedroom units average US $600 per month compared to US $500 in Toul Kork.

In Tonle Bassac and Toul Tom Poung (Russian Market), one-bedroom units average US $600 per month compared to US $500 in Toul Kork.

Major handovers are expected in 2025, including Le Condé BKK1 (1,000+ units), Vue Aston (800 units), and Time Square 306 (350 units), bringing over 2,000 units to the market. According to data in the report, on average, it takes around 12 to 18 months after a new apartment building is completed to fully understand how the rental market absorbs the new stock

You can see additional case studies, real estate checklists, a breakdown of fees, and more are available in the report, which can be downloaded for free.

Comments