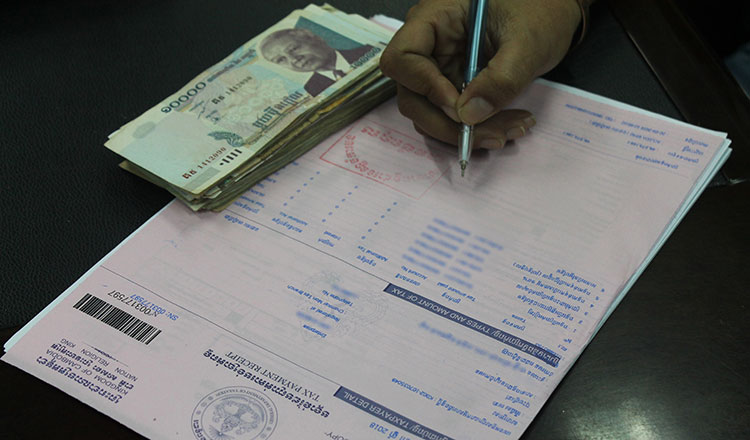

The General Department of Taxation in Cambodia consistently exceeds yearly targets, giving the government much-needed funds for social programs and infrastructure development. Photo from Khmer Times.

Cambodia’s Capital Gains Tax (CGT) is delayed for the 4th time until the end of 2028. The postponement of the tax likely stems from the government’s record of waiving taxes and other fees to further foster economic activity, especially in the Kingdom's real estate market.

Contrary to popular belief, the Capital Gains Tax is not a new tax; businesses in the Kingdom have always paid this tax. The CGT that was supposed to go into effect recently was an expansion of its tax base, specifically covering individuals buying and selling properties.

Before the pandemic, the surge seen by the construction and real estate sector was driven by high interest from foreign investors looking at Cambodian properties. In 2019, capital investments in construction amounted to over $9 billion and grew to over $10 billion two years later in 2021.

Despite the pandemic, the country’s real estate market has largely remained afloat with much of the sector shifting its focus to the local market. According to CBRE Cambodia’s Fearless Forecast 2022, the compound annual growth rate for the CBD and inner city is around 10% over a decade while those of the outer suburbs went up as high as 20% over the same period.

Phnom Penh’s urbanisation continues to expand on the back of the local market’s desire to have landed homes - a demand most apparent in the suburbs developing in the districts of Chroy Changvar, Sen Sok, Por Sen Chey and Meanchey.

How does the Capital Gains Tax work?

Cambodia's upcoming Capital Gains Tax is considered one of the most generous in the region. Photo from Khmer Times.

Cambodia’s Capital Gains Tax is a flat 20% rate from selling a capital asset. The CGT covers capital gained from selling: Immovable Properties (real estate), Leases, Investment/Financial Assets, Goods (Licenses & Branding), Intellectual Property, and Foreign Currency.

As mentioned earlier, the current CGT is an expansion of the tax from businesses to individuals. According to Realestate.com.kh’s overview of Capital Gains Tax, the CGT expands its tax base to Resident Taxpayers and Non-Resident Taxpayers. Persons falling into these categories are obligated to pay their CGT within 3 months of realising their gains.

There are currently two methods taxpayers can employ when paying their dues. First is the Actual Expense Deduction Method and the second is the Determination Based Method.

The Actual Expense Deduction Method takes the sales total proceeds and subtracts the expenses the seller made to get the Capital Gains Tax to be paid. These deductibles can be the purchase cost, consulting fees, registration tax, commissions, and even advertising. These expenses are taken from the final proceeds and 20% of the difference will be the Capital Gains Tax to be paid. This method is beneficial for property sellers who spend a lot on overhead/operational costs.

The Determination Based Method takes 80% of the sales proceeds and subtracts them from the entire sales value. The difference will be the Capital Gains and 20% of it will be the Capital Gains Tax to be paid. This method is highly beneficial for property owners who buy low and are planning to sell high.

Under the current version of the CGT, taxpayers are free to choose which method they feel will be a lighter tax obligation for them.

Implementation of the CGT has been a long time coming and many developing nations have their iterations. The CGT’s base expansion is expected to further add to the General Department of Taxation’s already impressive consistency of exceeding its yearly targets.

Article by:

Comments