Sarah Nicholson seeks to explain emerging markets, once and for all, in her “Overseas Property: The increasing popularity of emerging markets explained” presentation, thanks to PropertyGuru Singapore.

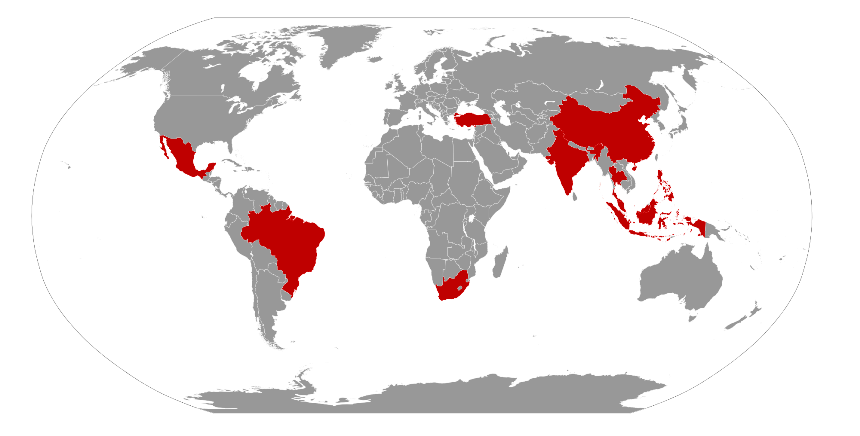

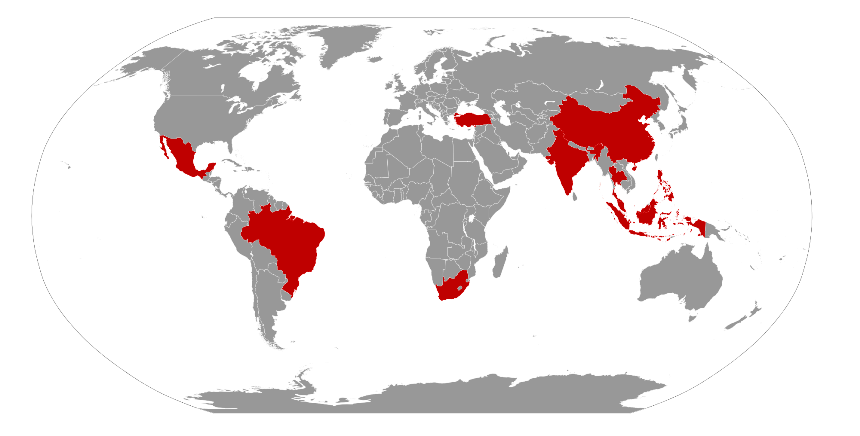

Nicholson is the international project marketing director for CBRE Asia Pacific. Nicholson qualifies that in 2015 – according to CBRE’s independent studies – emerging markets form 80% of the global population and 20% of the world’s economy and deeply affect how investors make decisions in 2016. What are emerging markets? Emerging markets are countries that have low to middle per capita income and are in a transitional state. This transitional state means they are moving to an open market through economic and exchange rate reforms that encourage both local and foreign investments, contributing to the overall growth of the country’s economy.  Why are emerging markets so popular?

Why are emerging markets so popular?

There are quite a few reasons why this type of market can be attractive to foreign and local investors, whether they’re looking for a long term or short-term investment project. According to Nicholson, emerging markets offer affordable opportunities for individuals and businesses to get a good investment return rate. She also states that economic and exchange rate reform programs help instill a sense of confidence in investors.

She says that it’s “going to just lead to a much stronger and more responsible economic performance levels. And it becomes a much more transparent and efficient economy” as these type of changes occur. To add to its charm, emerging markets also offer strong domestic and export-led growth. This means that there will be more opportunities for construction, employment, and business which may or may not be limited to real estate.

Cambodia as an emerging market:

Although Cambodia is experiencing a delay in the release of an accurate house price index, Nicholson assures that Cambodia is well on its way to becoming one of the most established markets in the South East Asian region. She adds that among the top three highest marketed locations in emerging markets are Malaysia, Thailand and Cambodia. This is according to the CBRE research for “Singapore Exhibitions for Emerging Market Residential Development” with data gathered from 2012 to 2015 H1.

Nicholson supports this by saying that among their dealings with Singaporean developers “Cambodia has gone from marketing nothing to 9 so far.” She also states that Phnom Penh land prices increased by 15 percent in 2013 and that “it feels like it’s just sort of at the beginning of that growth period which is really at the stage you want to be considering investing into these markets.” House loans are also increasing, which means that there is a lot more money circulating in the economy and that there are a lot more people now who can afford buying properties. Most of these loans come from local investors or individuals.

This is important for foreign investors because it helps them with their exit strategy because when it comes high time to sell, as you are able to sell to locals. So – according to Nicholson – if there are no local buyers, then that’s a red flag for a project. Despite this though, Cambodia does have a bit more work to do in terms of its interest rates and its predominantly poor population.

Reminders when investing in emerging markets:

In addition to discussing the advantages and disadvantages of buying into emerging markets in different countries around Asia, Nicholson also discussed a few things that might be helpful for different kinds of investors. She states that emerging markets present a bigger risk so this might only appeal to people who are looking to diversify their investment portfolios.

Although first-time investors will also find great opportunities in these countries, Nicholson warns them to keep careful watch of how their investments are handled. In these cases, make sure to buy from a developer with a strong track record and a high success rate so that you’re sure to reach your investment’s potential.

Nicholson also advises to monitor supply and demand as these are also strong indicators for which direction prices will go for preceding years. Data from emerging markets may be scarce and difficult to obtain, but once you gather enough insight and proceed with the proper mindset and expectations, investing in these types of markets may offer you more than you’d expect when it’s time to cash out.

It’s essential to remember though that policies are still being developed in these countries and may require a bit of patience.

Stay tuned and get more updates from Realestate.com.kh!

Comments