There has been plenty of media coverage on the speculative and approved logistics projects and aligned infrastructure in the Kingdom. The push for investment from the government and private-public partnerships in the logistics sector could be a boon for all industries, including the demand for specialised commercial property and result in rising land prices in Cambodia.

Comprehensive Intermodal Transport Master Plan 2022-2030 (CIT-MP)

Minister of Public Works & Transport H.E. Sun Chanthol has provided recent updates on the Comprehensive Intermodal Transport Master Plan 2022 – 2030. More than 150 projects have been identified for investment - needing a total of around US$30 billion. There were hundreds more projects that have not yet been approved (around 332 projects needing a total combined investment of $48.6 billion).

Most of these identified projects fall under the various master plans which are in varying degrees of competition and approval in the Kingdom.

The CIT-MP is a large and comprehensive plan which includes infrastructure such as roads, railways, waterways, airways, logistics and ports. The main goal is the improvement and modernisation of the logistics framework to ensure the Kingdom can be elevated to a tech-savvy regional hub by 2030. offering world-class infrastructure within ASEAN.

Logistics and Infrastructure in Cambodia

At the start of the year, we outlined a selection of key investments and new infrastructure projects. Most of these are on track and have had updates - but significantly even more projects have been announced to enhance logistical endeavours and upgrade major transport routes to ensure connectivity domestically and regionally.

Some of the new projects announced since the start of 2023 are:

- Bassac Sea Link Project - Aims to connect the Bassac River to a seaport in Kep province, and the Bassac River to the Gulf of Thailand, providing direct access from the Phnom Penh Port to Cambodia’s seaports.

- Several more bridges are under construction; such as the tallest bridge in the country on National Road No.10, connecting Battambang and Pursat Provinces with Koh Kong Province.

- Expressways – The completed Phnom Penh-Sihanoukville Expressway, since its launch in October 2022, has seen more than 2.5 million vehicles make use of it. The Phnom Penh-Bavet Expressway construction is due by mid-2023 and could connect with a new freeway on the Vietnamese side to offer quicker access between the capital of Cambodia and Ho Chi Minh. A study is also being carried out on a Siem Reap Expressway connecting to Phnom Penh.

- Railways – No real concrete progress has been made but several options are still being explored to improve and modernise the rail network for freight and passengers and interconnect Cambodia to the region.

- Coastal Development - a government-approved massive satellite city project in Kep is set to drastically increase land prices and 2 islands in Koh Kong and Preah Sihanouk have had investment projects worth $40 million approved.

How Much Can Logistics Grow in Cambodia

In a recent presentation from Profitence, they stressed that ongoing policy dialogue between the private sector and the government is crucial and that the Kingdom has the benefit and advantage of learning from best practices abroad. The private sector can capitalize on this and international companies can transfer their technology and market know-how into Cambodia.

- Air passenger traffic could grow to between 26.5 and 30.5 million annually - the new much larger and modern airports are key to this - but also their transport connectivity domestically and the hotels, F&B, tourism etc built around the vicinity.

- Air cargo is predicted to reach 350,000 to 400,000 tonnes, railway freight could reach eight million tonnes per year and 1.5 million passengers annually by 2030 - all freight is set for growth as facilities are added, improved, and systems modernised and digitised.

Impact on Land Prices

The January 2023 land prices from the Ministry of Economy and Finance of Cambodia suggested land prices are higher when situated close to main roads and infrastructure, while land bordering rivers or lakes impacts price valuations and may contribute to a higher land price.

Although property prices have stabilised, data suggests land prices are still on the move in the popular areas of the capital. This will be driven by local and foreign buying interest, and comparatively stronger economic growth for the region in the untapped potential of the economy.

In developed markets, the limited availability of land in prime city locations has driven up land values, and to alleviate demand and rental pressures, several authorities are establishing logistics hubs in neighbouring cities and provinces. This is where Cambodia should be targeting investment.

What will Drive Growth - E-Commerce & Logistics Opportunities

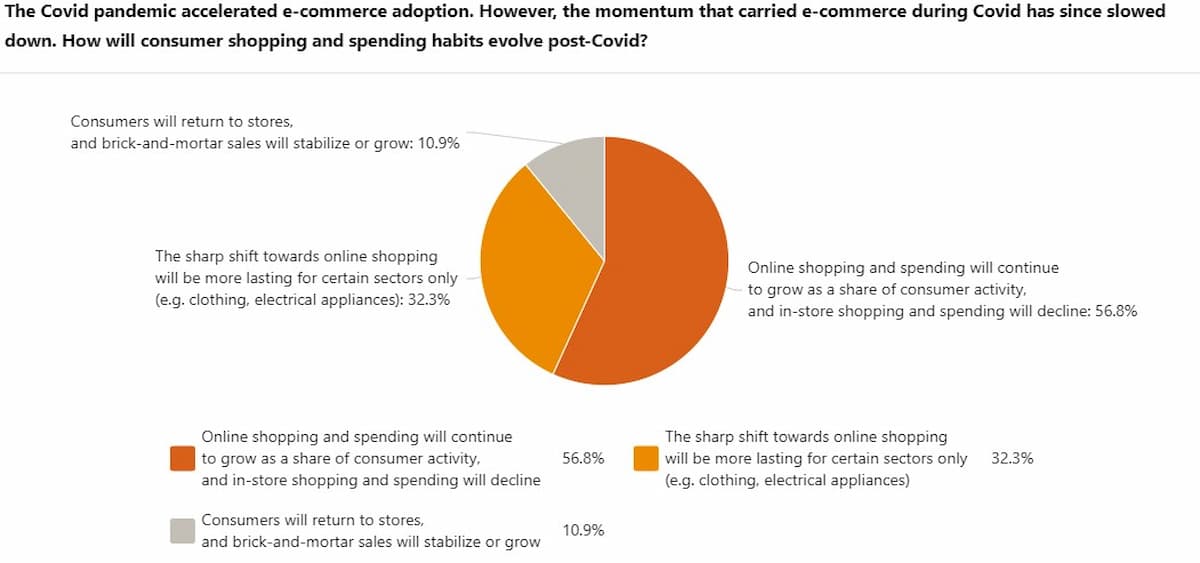

The Southeast Asia E-Commerce Industry Report 2023 says that the Gross merchandise value (GMV) of e-Commerce increased from USD $10.9 billion to $131 billion between 2017-2022 in the region.

The State of Logistics Asia-Pacific Focus Report 2023 also adds the surge in demand from e-commerce operators during the pandemic threw the entire logistics sector off as “asset owners were ill-equipped with the necessary space to accommodate it, particularly institutional grade properties.”

As the emerging market with the fastest economic growth and greatest development potential, the e-commerce industry in Southeast Asia has developed very quickly and continues to cater to the regional population of over 600 million. Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

Within the region, Cambodia is tapped to have the strongest GDP growth.

- Yahoo Finance ranked Cambodia as the 14th Fastest Developing Country in 2023 with an expected GDP growth of 5.8%.

- Cambodia was ranked tied second with Vietnam for regional GDP growth according to the International Monetary Fund, projecting 5.8 per cent growth in 2023.

- The Asian Development Bank has projected Cambodian GDP growth of 5.5 per cent in 2023 but rising to 6.0 per cent in 2024.

- The governor of the National Bank of Cambodia, Chea Chanto, has set a 6 per cent target for 2023.

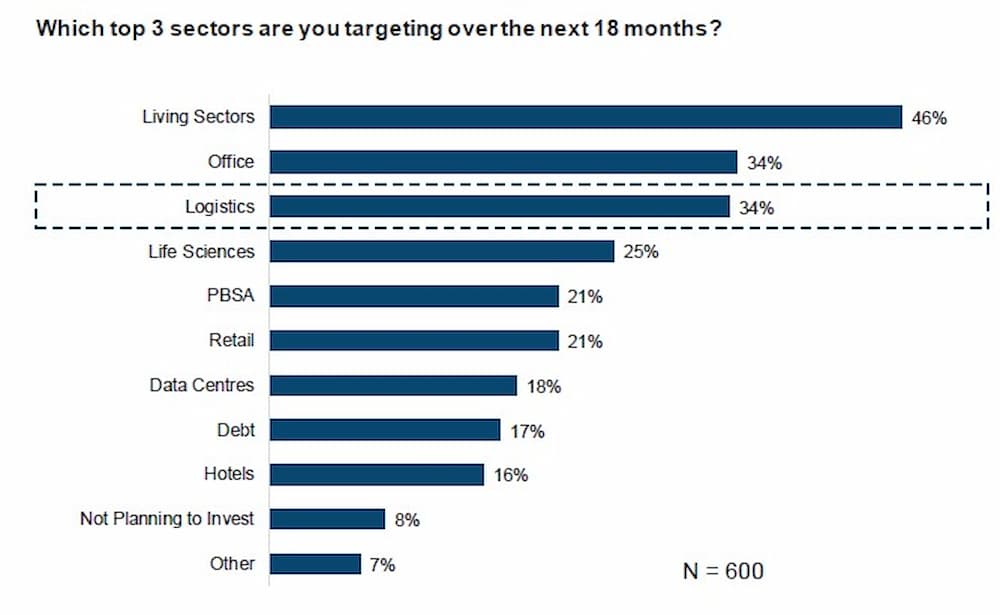

The State of Logistics Report also highlighted the potential of an emerging market like Cambodia’s. “With evolving supply networks, emerging Southeast Asia is set to become an important investment market for logistics real estate. The region remains critical to supply chain diversification… In the longer term, its e-commerce potential is massive given its considerable and growing consumer class.”

- According to TikTok and Boston Consulting Group, the e-commerce gross market value (GMV) in APAC is estimated to reach US$3.5 trillion by 2025.

- Rebalance of supply chains and increased resilience – the decoupling from China will make SEA a top destination for foreign direct investment among emerging regions.

Much of the domestic strategic planning needs to tap into technological trends and build now for the future. The Asian Development Bank (ADB) indicated that technology and big data are key to fast-tracking economic recovery in Southeast Asia (SEA).

In terms of commercial spaces in the Kingdom, investors are still able to secure land and large-scale properties that can accommodate a range of logistical and technological needs and still be situated relatively close to urban city centres, and major new transport and logistics hubs. The rising price of land and property in the future will make these ambitions more expensive.

Japan for example is sending an investment delegation for the third time in November 2023 to study potential investment projects in Cambodia such as factories, science and technology parks and EV charging stations. They have already been funding the Cambodia Post Operational Processes Upgrade to help transform Cambodia Post by upgrading processes, training and facilities to automate tracking and delivery of goods and better recording and delivery of services.

For overseas investors now is an opportune time to gain long-term benefits as in-city hubs, urban warehouses and the needs in new satellite cities only gain in popularity.

Comments