2015 was a somewhat turbulent year for emerging markets as oil and commodity prices slid, effectively affecting interest rates and GDP negatively. In contrast, 2016 brought good news as the commodity index rose by 6 percent and oil prices by 22.8 percent – restoring the confidence of investors.

This is according to the Global MarketFlash Report released by CBRE on September 20, 2016.

Can this also be indicative of what’s coming for the real estate market?A Good Omen?

Data gathered by CBRE shows disparity between attracting funds in the bond market and real estate market. They explain that due to a narrowing of real estate yields, correct risk pricing in the bond and stock markets can produce real estate yields of over 6.5 percent, and this will be attractive for investors.

As a result, slight increase in capital flows are expected in the next few years for emerging markets, collectively.

CBRE Global Research has also observed investors taking interest to explore emerging markets and the real estate opportunities there - primarily due to near-zero interest rates across developed markets.

The Relevance?

The Cambodian real estate market is considered to be one of the fastest emerging markets in Southeast Asia and therefore should be affected by this data.

Muyngim Lim, analyst at CBRE Cambodia, says, “While Cambodia is yet to attract the level of interest enjoyed by a number of more well-established, neighbouring markets, the combination of continued GDP growth, low barriers to entry and an ever-growing international profile will likely continue to create an environment conducive to significant inward investment over the course of the year.”

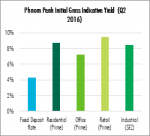

Lim explains, “Cambodia currently benefits from the highest rental returns within the Southeast Asia region, with estimated gross initial yields standing at an average of 8.5 percent across principal property types.” Lim continues, “The first eight months of 2016 have witnessed an unprecedented volume of developer activity, with a total project value of $7.2 billion being approved nationally, representing a notable increase from the $3.3 billion approved over the course of 2015.”

While the outlook is generally slow, the data suggests that activity in the market may drive an increase in investments soon, further catapulting the country into the international market as one of the more well-established markets in Southeast Asia.

Different factors will still come into play as emerging markets make a rebound, but we have yet to see whether what is true today will remain true tomorrow in the Cambodian real estate sphere.

Comments