Like in many other countries, property investment has become a popular way to build wealth, and Cambodia is no exception.

The Kingdom's real estate market offers attractive opportunities for those aiming to diversify their wealth and portfolio. There is an opportunity to fully own property, often at more reasonable prices and in better locations compared to other parts of Southeast Asia. Moreover, freehold ownership options are available to foreigners enhancing its appeal.

But what is the best investment strategy? Should one invest in apartments, or landed property? Off-plan or pre-existing home, and should the focus be on capital growth or yield? Furthermore, what types of real estate are accessible for purchase by foreign nationals?

In this article, we will provide our insights into these questions that investors may have before making an investment.

Investment: Off-Plan and Existing Homes

When exploring the property market, you're typically presented with two primary choices: off-plan or existing properties.

Off-plan Property

Off-plan properties are chosen based on architectural plans representing homes that have yet to be constructed. On the other hand, existing properties are ready for immediate move-in, allowing for a swift transfer post-contract signing and payment.

Investors often receive early notifications about off-plan project launches, presenting an opportunity to secure units at lower prices. This early-bird advantage can significantly enhance profit margins, as buying at this stage usually involves just a down payment and a booking fee. This procedure makes the initial financial commitment more manageable.

Furthermore, off-plan properties offer the benefit of customisation, giving buyers the freedom to personalise their space according to their tastes.

Off-plan projects, particularly those developed by new companies, should be approached with caution. It is advisable to conduct thorough research on the company's background and its previous projects. Furthermore, we recommend consulting with a reputable real estate advisor to gain deeper insights.

.jpg.jpg)

Credit Picture: Le Condé BKK1

To view this project listing click here

Existing Property

Purchasing an existing property eliminates the uncertainties and delays associated with the construction of an off-plan project. Though these properties tend to be pricier due to their ready-to-use status, their prices may decrease in situations with oversupply and low buyer demand, potentially offering good value.

In summary, both options have their unique advantages and considerations, from the cost-saving and customisation potential of off-plan properties to the immediacy and certainty of existing homes. It depends on the buyer's strategy and needs.

Credit Picture: Realestate.com.com

To view this villa listing click here

Understand market trends and find the right opportunity

Real estate is a market that fluctuates depending on its demand and supply. When there are a large number of buyers in the market looking for a property to live in or invest in, prices tend to rise and become more competitive, while when there are fewer buyers in the market, sellers are more willing to negotiate, giving investors the opportunity for a good deal.

In times of low demand, this is an opportunity for homebuyers who have sufficient funds on hand. Home buyers can negotiate effectively with sellers to get the lowest price.

After Purchase Strategy: Capital appreciation or rental returns

In real estate, capital appreciation refers to the increase in a property's value over time, influenced by factors such as location, demand, and economic conditions.

For investors, the main objective is to profit from capital appreciation by buying property at a lower price and selling it at a higher price in the future. In the case of off-plan properties, their value typically peaks as they near completion, whereas, for existing properties, house flipping is a common strategy that can significantly enhance the property's value. On the other hand, rental return, also known as rental income or yield, is the income earned from leasing out a property to tenants.

To ensure a steady demand for rentals, investors should focus on prime locations and consider other factors like property demand and tenant requirements.

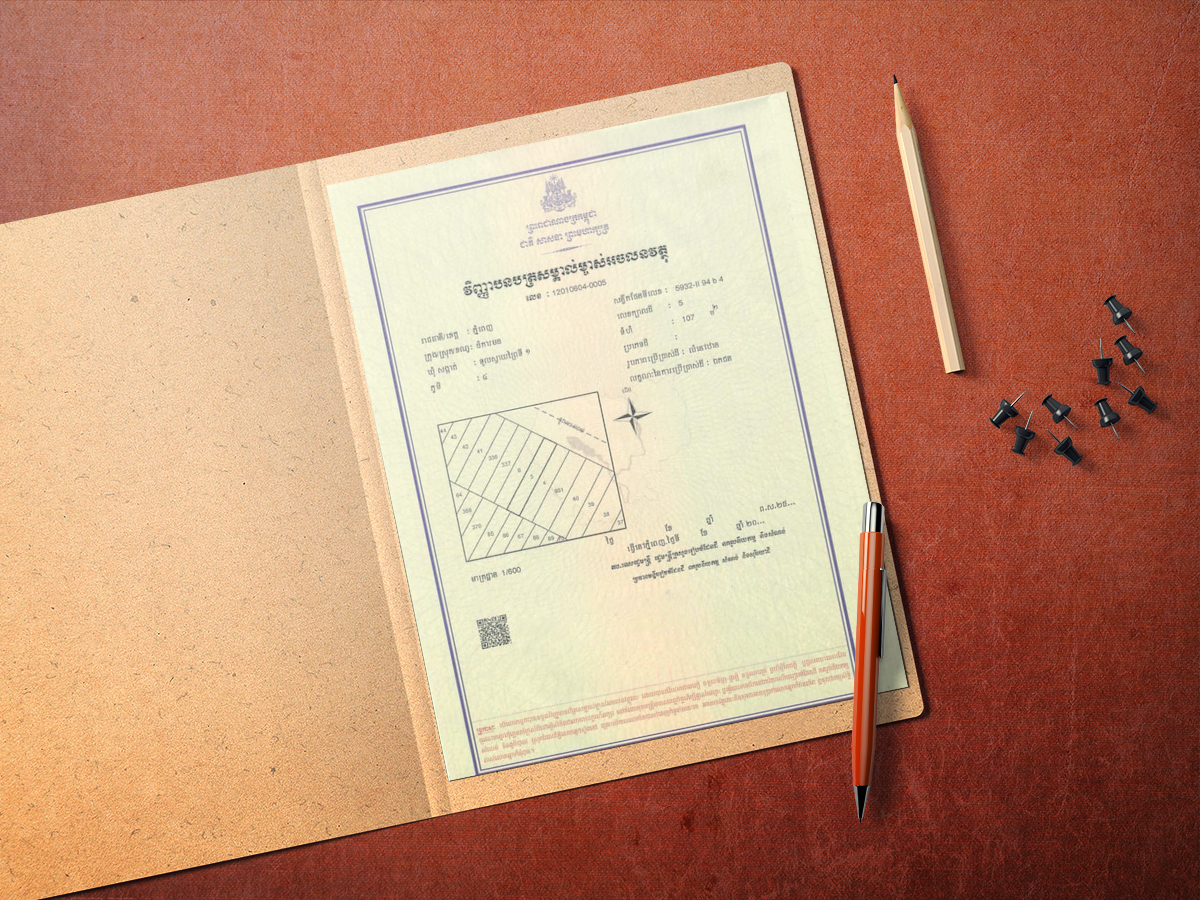

Ownership

In Cambodia, individuals are granted the opportunity for freehold ownership of various types of real estate. Cambodian citizens can fully own real estate, provided all legal procedures are correctly followed. Among the different ownership schemes available, hard-title ownership stands out as the most secure option. For further details, please refer to our comprehensive guide on title ownership here

For foreign investors, it is slightly different, yet there remain investment opportunities. Specifically, condominiums and apartments constructed after 2010 are available for foreign purchase under the strata-title scheme.

The strata-title stipulations include a prohibition against purchasing ground-floor units and a requirement that 30% of a property must be owned by Cambodians, while up to 70% can be owned by foreigners, and the property should not be within 30km of the nearest land border.

It's important to note that foreigners are generally prohibited from owning land or landed properties in Cambodia. However, various mechanisms have been put in place to facilitate investment. According to BNG Legal resources, leasehold agreements allow investors to lease property for a minimum period of 15 years, but can only be for a maximum of 50 years, with options for renewal for a period not exceeding 50 years. Other methods, such as nominee structures, landholding companies, or the trust law, offer alternative forms of ownership for real estate investors. To read more about alternatives to owning property click here.

In summary:

Apartment Investment: Off-Plan vs. Existing Properties:

- Off-plan properties offer early investment benefits, customization options, and potentially lower prices but require due diligence on the developer's reputation.

- Existing properties provide immediate occupancy and less uncertainty, though they may come at a higher cost, with pricing influenced by market supply and demand.

Understanding Market Trends:

- Real estate prices fluctuate based on demand and supply dynamics, presenting negotiation opportunities for buyers when demand is low.

After Purchase Strategy: Capital Appreciation vs. Rental Returns:

- Capital appreciation involves profit from selling property at a higher price over time, suitable for both off-plan and existing properties.

- Rental returns offer steady income from leasing properties, with success dependent on location, demand, and property features.

Ownership Opportunities in Cambodia:

- Cambodian citizens and foreigners can enjoy freehold ownership, with hard-title ownership being the most secure option.

- Foreigners can purchase condominiums and apartments with strata titles post-2010 built buildings, adhering to specific ownership ratios and geographical restrictions.

- While direct land ownership is restricted for foreigners, leasehold agreements, nominee structures, landholding companies, and trust laws provide viable investment mechanisms.

If you're seeking real estate in Cambodia, visit our website and social media channels for options. For personalised assistance, contact our customer service team.

Realestate.com.kh helps you navigate Cambodia's real estate market.

📞+855 92 92 1000

Comments