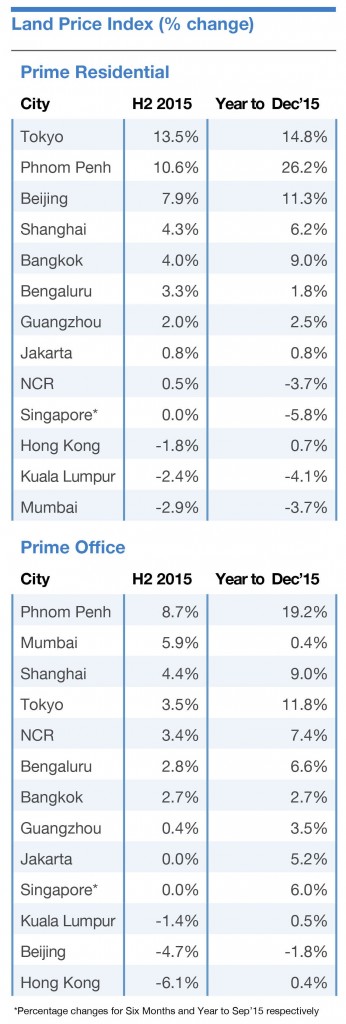

Knight Frank Prime Asia Development Land Index shows prices of residential sites in the region appreciating 3.0% in H2 2015, up from the 1.2% seen in the previous six months. On the other hand, the price growth of office land slowed to 1.5% from 3.6%

Knight Frank Prime Asia Development Land Index shows prices of residential sites in the region appreciating 3.0% in H2 2015, up from the 1.2% seen in the previous six months. On the other hand, the price growth of office land slowed to 1.5% from 3.6%

Report highlights:

Report highlights:

- H2 2015 witnessed development land investment volumes in Asia rise by 14.1% year-on-year.

- Cross-border volumes increased by 55.3%, driven by intra-Asian investment flows.

- China bought almost two times more land in the rest of Asia.

- While the average price of a piece of development land has been climbing steadily since mid-2012, the average land size has been shrinking.

- In Indonesia, the government’s efforts to tackle tax evasion is discouraging big-ticket purchases.

Comments