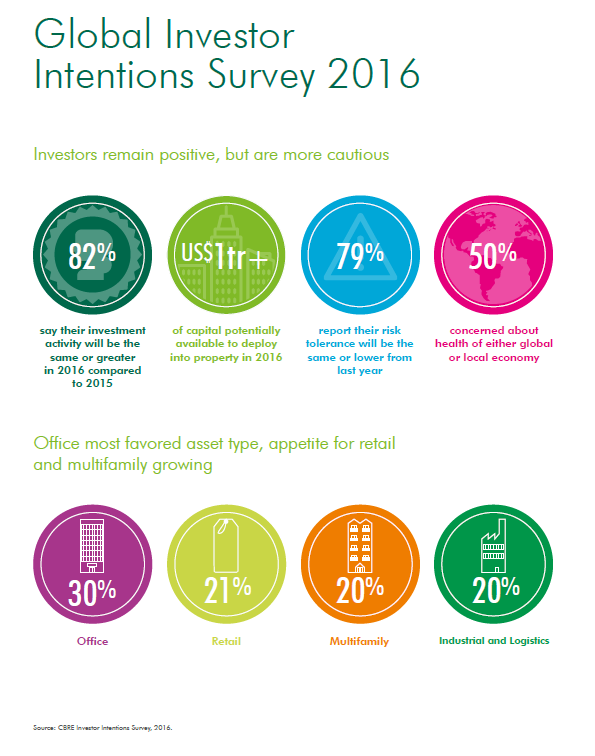

“The report highlights global investors’ clear appetite for expansion, with 82% of respondents indicating that their investment activity will be the same or greater compared to 2015. 37% of those surveyed stated capital appreciation as their principal requirement, combined with a renewed focus on core assets benefiting from consistent revenue streams," said Chris Hobden - Manager of Research, Consulting & Valuation at CBRE Cambodia.

“The report highlights global investors’ clear appetite for expansion, with 82% of respondents indicating that their investment activity will be the same or greater compared to 2015. 37% of those surveyed stated capital appreciation as their principal requirement, combined with a renewed focus on core assets benefiting from consistent revenue streams," said Chris Hobden - Manager of Research, Consulting & Valuation at CBRE Cambodia.

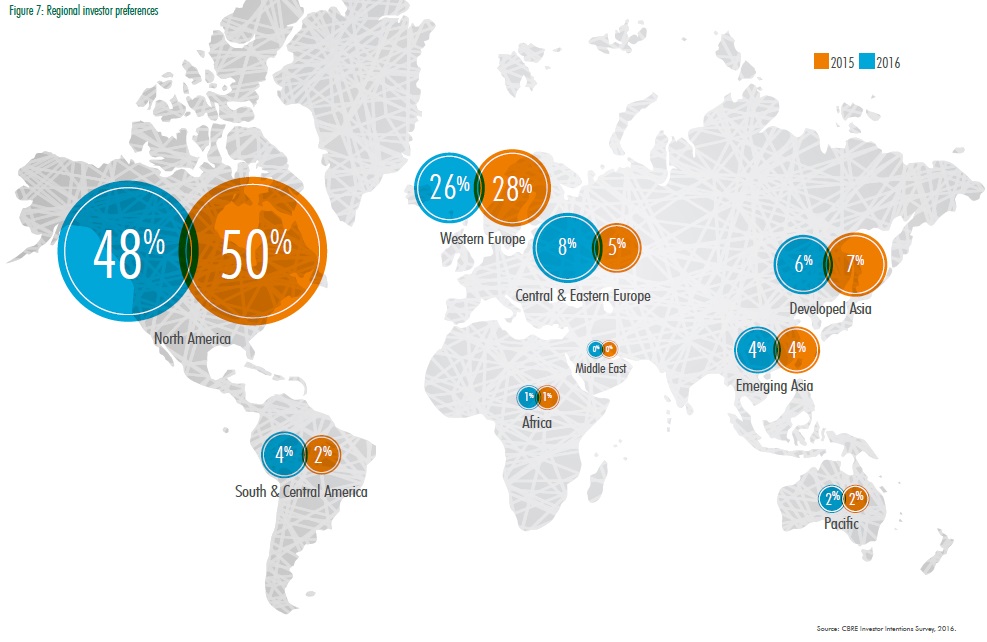

While there is currently limited existing stock of significant, income-bearing commercial assets being offered in the Phnom Penh market, we saw a clear rise in interest from international groups in exploring such opportunities in country over 2015. As the local market develops further, and a greater diversity of stock comes on stream, we feel that Cambodia will be well placed to draw attention from the 4% of major global investors noting ‘Emerging Asia’ as their primary focus for investment over the course of the year,” continues Hobden.

While there is currently limited existing stock of significant, income-bearing commercial assets being offered in the Phnom Penh market, we saw a clear rise in interest from international groups in exploring such opportunities in country over 2015. As the local market develops further, and a greater diversity of stock comes on stream, we feel that Cambodia will be well placed to draw attention from the 4% of major global investors noting ‘Emerging Asia’ as their primary focus for investment over the course of the year,” continues Hobden.

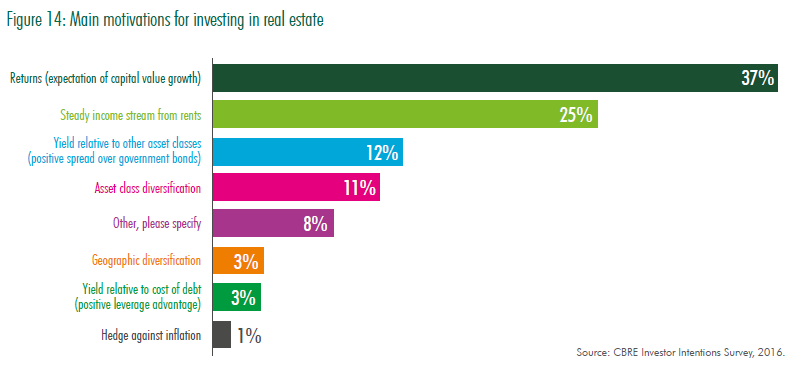

Property returns are particularly appealing in low‑yield world according to the CBRE report: “The single most important motivation for investment in real estate is the expectation of capital gains: 37% of respondents state this is their main reason for investing in the sector (Figure 14). Americas based investors are more interested in this component of return than those of other regions. This said, 25% of global investors mention the steady income from rents and a further 15% say yield relative to debt or other asset classes as their top motive. EMEA-based investors have a relative preference for income and yield. Asset class diversification is most important for 11% of investors, but only 3% state that geographic diversification is important. As interest rates in some areas of the world head into negative territory and are set to remain lower for longer in others, we suggest returns will continue to attract capital even if there is only modest rental growth.”

Property returns are particularly appealing in low‑yield world according to the CBRE report: “The single most important motivation for investment in real estate is the expectation of capital gains: 37% of respondents state this is their main reason for investing in the sector (Figure 14). Americas based investors are more interested in this component of return than those of other regions. This said, 25% of global investors mention the steady income from rents and a further 15% say yield relative to debt or other asset classes as their top motive. EMEA-based investors have a relative preference for income and yield. Asset class diversification is most important for 11% of investors, but only 3% state that geographic diversification is important. As interest rates in some areas of the world head into negative territory and are set to remain lower for longer in others, we suggest returns will continue to attract capital even if there is only modest rental growth.”

Comments