ទី ៣៖ ទិដ្ឋភាពទូទៅនៃវិស័យអចលនទ្រព្យកម្ពុជា

វិស័យអចលនទ្រព្យ និងសំណង់នៅកម្ពុជាមានការរីកចម្រើនគួរឱ្យកត់សម្គាល់ក្នុងរយៈពេលមួយទសវត្សចុងក្រោយនេះ ដោយសារការអភិវឌ្ឍសេដ្ឋកិច្ចទូទាំងប្រទេស ការវិនិយោគពីបរទេស និងប្រជាជនថ្នាក់កណ្តាលជំនាន់ថ្មីកំពុងស្វែងរកផ្ទះនៅកណ្តាលទីក្រុងសំខាន់ៗ។

ម៉្យាងវិញទៀតការពង្រឹងច្បាប់ជាប្រចាំជុំវិញភាពជាម្ចាស់កម្មសិទ្ធិរបស់ជនបរទេស និងជំនាញវិជ្ជាជីវៈនៃការអភិវឌ្ឍអចលនទ្រព្យ និងភ្នាក់ងារនានាបាននាំឱ្យមានការភាន់ច្រឡំជាបន្តបន្ទាប់នៅក្នុងទីផ្សារអចលនទ្រព្យទាំងមូល។

ទោះយ៉ាងណាការស្ទង់មតិនេះក៏បានផ្តល់ទិន្នន័យ ដែលបង្ហាញថាអ្នកប្រើប្រាស់ជាច្រើនយល់ឃើញពីភាពទន់ខ្សោយនៅក្នុងទីផ្សារពោលគឺអចលនទ្រព្យដែលមានតម្លៃសមរម្យ តម្រូវការហិរញ្ញវត្ថុនៃការទិញអចលនទ្រព្យ និងគម្លាតនៅក្នុងទីផ្សារទាក់ទងនឹងវិជ្ជាជីវៈ និងតម្លាភាពក្នុងការលក់អចលនទ្រព្យ និងវិជ្ជាជីវៈវាយតម្លៃ។

បើនិយាយពីការវិនិយោគលើវិស័យសំណង់ និងអចលនទ្រព្យនៅទូទាំងប្រទេសនេះនៅតែបន្តលេចធ្លោដោយមានគម្រោងសរុបចំនួន ៣,៤១៨ ត្រូវបានអនុម័តកាលពីឆ្នាំមុន ដែលមានចំនួនសរុប ៦.៨ ពាន់លានដុល្លារ។ កំណើនថេរនេះបង្ហាញពីទំនុកចិត្តរបស់វិនិយោគិន ទាំងសេដ្ឋកិច្ច និងទីផ្សារអចលនទ្រព្យបានបង្ហាញពីស្ថេរភាពជាប្រចាំ និងការឡើងចុះតិចតួចបំផុតចាប់តាំងពីឆ្នាំ២០១៣។

ស្របពេលដែលប្រទេសចិនដឹកនាំទុនវិនិយោគសម្រាប់ការវិនិយោគនៅប្រទេសកម្ពុជា ជប៉ុន កូរ៉េខាងត្បូង តៃវ៉ាន់ ម៉ាឡេស៊ី សិង្ហបុរី និងហុងកុងក៏បានចាប់ផ្តើមបញ្ចេញទុនវិនិយោគសម្រាប់ការអភិវឌ្ឍសំណង់ និងអចលនទ្រព្ យដែលជាហេតុធ្វើឱ្យមានភាពចម្រុះនៃក្រុមវិនិយោគិន។ ការវិនិយោគទាំងនេះក៏ពង្រីកដល់ការអភិវឌ្ឍហេដ្ឋារចនាសម្ព័ន្ធសំខាន់ៗផងដែរដែលចាំបាច់សម្រាប់ទីផ្សារអចលនទ្រព្យបន្តជារីកលូតលាស់ ពិសេសនៅក្រៅមជ្ឈមណ្ឌលសំខាន់ៗនៃរាជធានីភ្នំពេញ ក្រុងព្រះសីហនុ និងសៀមរាប។

ប្រទេសនេះក៏បានមើលឃើញពីការកើនឡើងគួរឱ្យកត់សម្គាល់នៃចំនួនក្រុមហ៊ុនអចលនទ្រព្យដែលបានចុះបញ្ជី ហើយក្រុមហ៊ុនអន្តរជាតិមួយចំនួនដូចជា Knight Frank, CBRE, Century 21 និង ERA បានចូលមកដល់ទីផ្សារ។ ក្រុមហ៊ុនអន្តរជាតិទាំងនេះ និងកេរ្តិ៍ឈ្មោះបស់ពួកគេដើរតួនាទីយ៉ាងសំខាន់ក្នុងការផ្តល់ឱ្យវិនិយោគិនសក្តានុពលឲ្យកាន់តែមានការជឿជាក់នៅក្នុងវិស័យអចលនទ្រព្យនៅកម្ពុជា។ នៅលើទីផ្សារសម្រាប់ការអភិវឌ្ឍថ្មីការឈានជើងចូលរបស់ក្រុមហ៊ុនអន្តរជាតិដូចជា Hongkong Land, Oxley Holdings, Creed Group, HLH Group, Prince Real Estate, R&F Properties, Meridian International Holdings, Yue Tai Group, Graticity Real Estate Development (GRED), TA Corporation និងក្រុមហ៊ុនជាច្រើនទៀតគឺបង្ហាញពីភាពជឿជាក់យ៉ាងខ្លាំងចំពោះសក្តានុពលរបស់ប្រទេសកម្ពុជា។

In the market for new developments, the entry of international firms such as Hongkong Land, Oxley Holdings, Creed Group, HLH Group, Prince Real Estate, R&F Properties, Meridian International Holdings, Yue Tai Group, Graticity Real Estate Development (GRED), TA Corporation and many more indicate strong confidence in the potential of Cambodia.

៣.១ ស្វែងយល់អំពីប្រភេទអចលនទ្រព្យ

មានប្រភេទអចលនទ្រព្យសំខាន់ៗជាច្រើន ដែលមាននៅទូទាំងព្រះរាជាណាចក្រកម្ពុជា។

ខុនដូខុនដូសំដៅទៅលើអគារ ឬបណ្តុំអគារដែលមានយូនីតលំនៅដ្ឋានសម្រាប់កម្មសិទ្ធិឯកជន។ ពាក្យនេះជាទូទៅសំដៅទៅលើការអភិវឌ្ឍន៍ដែលត្រូវបានសាងសង់បន្ទាប់ពីការអនុវត្តច្បាប់ឆ្នាំ២០១០ ស្តីពីការផ្តល់ឲ្យជនបរទេសនូវសិទ្ធិជាម្ចាស់នៅក្នុងអាផាតមិនឯកជននៃអគារសហកម្មសិទ្ធិ ដែលជាច្បាប់ចម្បងអនុញ្ញាតឱ្យជនបរទេសមានកម្មសិទ្ធិ (យូនីតខុនដូ) ជាប្លង់កម្មសិទ្ធិរួម ដែលអនុលោមទៅតាមលក្ខខណ្ឌមួយចំនួននៃច្បាប់។

នៅក្នុងប្រទេសកម្ពុ អាផាតមិនជាទូទៅខុសគ្នាពីខុនដូដោយកត្តាមួយចំនួន។ អាផាតមិនជាទូទៅត្រូវបានគេរកឃើញនៅក្នុងអគារដែលត្រូវបានសាងសង់មុនឆ្នាំ២០១០ ហើយមិនមានសិទ្ធិទទួលប្លង់កម្មសិទ្ធិរួមទេ។ អាផាតមិនជាទូទៅមិនខ្ពស់ដូចខុនដូទំនើប និងការអភិវឌ្ឍន៍ចម្រុះទេ។ លើសពីនេះទៀតអាផាតមិនជាទូទៅមិនផ្តល់សេវាកម្មបន្ថែមជូនទេ។ ម៉្យាងវិញទៀតខុនដូជាធម្មតានឹងមានបំពាក់សេវាកម្មប្រើប្រាស់ទូទៅដូចជាអាងហែលទឹក និងកន្លែងហាត់ប្រាណ។ ទោះយ៉ាងណាពាក្យទាំងពីរនេះច្រើនតែមានលក្ខណៈដូចគ្នា ហើយត្រូវបានប្រើប្រាស់ដូចគ្នានៅក្នុងព្រះរាជាណាចក្រ។

វីឡាផ្ទះដាច់តែឯងត្រូវបានគេហៅថា ផ្ទះវីឡា ហើយជាទូទៅមានសួនច្បារ ឬតំបន់ក្រៅ។ វីឡាមាននៅទូទាំងប្រទេស ហើយត្រូវបានប្រើសម្រាប់ដាក់ទាំងអាជីវកម្ម រស់នៅលក្ខណៈគ្រួសារ និងជួលឲ្យបរទេស។ នៅតំបន់កណ្តាលក្រុងភ្នំពេញ ផ្ទះវីឡាដែលមានការថែរក្សាល្អ មានតម្រូវការខ្ពស់។ មានទាំងវីឡាដែលទើបសាងសង់ថ្មី និងវីឡាសម័យអាណានិគមដែលបានសាងសង់ឡើងវិញ។

ជាប្រពៃណី វីឡានៅក្នុងទីក្រុងត្រូវបានប្រើសម្រាប់គោលបំណងទាំងអស់ដូចជាហាងទំនិញ ការិយាល័យ និងលំនៅដ្ឋានសម្រាប់រស់នៅ។ ទោះយ៉ាងណាជាមួយនឹងការអភិវឌ្ឍអចលនទ្រព្យយ៉ាងខ្លាំងនៅតាមបណ្តាខណ្ឌសំខាន់ៗក្នុងរាជធានីភ្នំពេញ សៀមរាប និងក្រុងព្រះសីហនុ ផ្ទះវីឡាជាច្រើនកំពុងត្រូវបានគេកម្ទេចចោល ដើម្បីសាងសង់អគារថ្មី និងការផ្គត់ផ្គង់វីឡាដែលមានទីធ្លាទំនេរ (ក្រៅពីការអភិវឌ្ឍបុរី) ចាប់តាំងពីពេលនោះមកបានធ្លាក់ចុះគួរឱ្យកត់សម្គាល់។

ផ្ទះវីឡាក៏ជាប្រភេទអចលនទ្រព្យឈានមុខគេក្នុងការអភិវឌ្ឍបុរីដែរ។ អ្នកអភិវឌ្ឍន៍បុរី តែងតែសាងសង់វីឡា វីឡាភ្លោះ និងប្រភេទផ្សេងៗទៀតនៅក្នុងគម្រោងរបស់ពួកគេ។ អចលនទ្រព្យទាំងនេះជាទូទៅមានតម្លៃខ្ពស់បំផុត។ វីឡាគឺជាប្រភេទអចលនទ្រព្យ ដែលពេញនិយមសម្រាប់គ្រួសារអ្នកមាននៅប្រទេសកម្ពុជាដោយចាប់ផ្តើមវិនិយោគលើដីមានទីធ្លាធំ សម្រាប់គ្រួសារសត្វចិញ្ចឹម និងយានជំនិះ។

ផ្ទះខ្មែរបុរាណផ្ទះបុរាណខ្មែរត្រូវបានធ្វើឡើងពីដើមឈើ និងសាងសង់លើសសរដើម្បីការពារពីទឹកជំនន់។ ទីធ្លានៅក្រោមផ្ទះត្រូវបានប្រើជាកន្លែងកម្សាន្ត និងអង្គុយលេងជាមួយគ្រួសារ ឬសម្រាប់ថែរក្សាបសុសត្វរបស់គ្រួសារឲ្យមានសុវត្ថិភាពនៅពេលយប់។

ដោយសារតែការរីកចម្រើនឥតឈប់ឈរនៃវិស័យអចលនទ្រព្យ ផ្ទះឈើភាគច្រើននៅតំបន់ក្រុងត្រូវបានកែលម្អ ហើយទីធ្លាដែលនៅពីក្រោមត្រូវបានប្រែក្លាយទៅជាបេតុង។ ភាគច្រើនត្រូវបានផ្លាស់ប្តូរទៅជាភោជនីយដ្ឋាន ឬប្រតិបត្តិការក្រុមហ៊ុនទេសចរណ៍។

ទោះយ៉ាងណានៅខាងក្រៅតំបន់កណ្ដាលទីក្រុង ផ្ទះបុរាណទាំងនេះនៅតែមានជាទូទៅជាពិសេសនៅតាមស្រុកនានា ដែលងាយនឹងទទួលបានរងទឹកជំនន់។

ផ្ទះអាជីវកម្ម និងផ្ទះអាជីវកម្មដែលកែលម្អឡើងវិញផ្ទះអាជីវកម្មបែបខ្មែរនៅតែជាប្រភេទអចលនទ្រព្យលេចធ្លោ ដែលមាននៅក្នុងប្រទេសកម្ពុជា។ ផ្ទះនេះជាទូទៅមានទំហំស្តង់ដារ ៤ ម៉ែត្រគុណ ១៦ ម៉ែត្រ (១៣ ហ្វីត គុណនឹង ៥២ ហ្វីត) ។ ជាផ្ទះអាជីវកម្មមានកម្ពស់ខ្ពស់ ២ ទៅ ៣ ឬ ៤ ដែលមានប្លង់វែង និងតូច។ ហាងលក់ទំនិញសាងសង់ឡើងជាជួរហើយមានជញ្ជាំងរួមគ្នាជាមួយផ្ទះជិតខាង។

ផ្ទះអាជីវកម្មត្រូវបានអនុញ្ញាតឱ្យមាននៅតាមដងផ្លូវនៅក្នុងផ្ទះជាប់ដី មានន័យថាគ្រួសារអាចបើកហាងតូចៗនៅក្នុងផ្ទះរបស់ពួកគេបាន។ រចនាបទផ្ទះនេះពេញនិយមសម្រាប់គ្រួសារកម្ពុជា ដោយសារហេតុផល ដែលអនុញ្ញាតឱ្យអាចរកប្រាក់ចំណូលបន្ថែមបាន ដោយហេតុថាផ្ទះនេះមានទីតាំងស្ថិតនៅក្នុងតំបន់ដែលមានមនុស្សច្រើន។ នៅក្នុងទីក្រុងនៅកម្ពុជា និងនៅតាមផ្លូវពាណិជ្ជកម្មសំខាន់ៗ ជាទូទៅម្ចាស់ផ្ទះអាចប្រើជាន់ផ្ទាល់ដីជាកន្លែងលក់ទំនិញ និងស្នាក់នៅជាន់ខាងលើ ប្រសិនបើពួកគេចង់រស់នៅទីនោះ។ ហាងលក់ឥវ៉ាន់ត្រូវបានជួលជាយូនីតនីមួយៗ ឬផ្ទះទាំងមូល។

ទាក់ទងនឹងគ្រឿងសង្ហារិមនៅក្នុងផ្ទះបាយ និងបន្ទប់ទឹក ផ្ទះអាជីវកម្មមានលក្ខណៈសមញ្ញបំផុត។ ទោះជាយ៉ាងណាក៏ដោយផ្ទះអាជីវកម្ម ដែលបានជួសជុលបានក្លាយជាការពេញនិយមកាន់តែខ្លាំងឡើង។ យូនីតថ្មីដែលបានកែលម្អរួចមានទំហំដូចគ្នានឹងផ្ទះអាជីវកម្មបែបប្រពៃណី ប៉ុន្តែវាបានរួមបញ្ចូលទាំងរចនាបថបែបលោកខាងលិចតាមរយៈការដាក់បញ្ចូលគ្រឿងបរិក្ខារទំនើប ៗ និងការរចនាផ្ទៃខាងក្នុង។ ផ្ទះអាជីវកម្មជាទូទៅមានជាន់ឡៅតឿ ដែលអាចធ្វើជាបន្ទប់គេងបន្ថែម។

សេវាកម្ម អាផាតមេនអឹផាតមិុនមានសេវាកម្មខុសគ្នាពាក់ព័ន្ធនឹងទំហំ រចនាបថ និងតម្លៃ ដោយអាស្រ័យលើទីតាំង និងគុណភាពនៃអគារអាផាតមេន។ សេវាកម្ម ដែលមាននៅក្នុងអាផាតមិនបែបលោកខាងលិចមានលក្ខណៈទូលំទូលាយជាងប្រភេទអចលនទ្រព្យផ្សេងទៀត ហើយត្រូវបានរចនាឡើងសម្រាប់អ្នកជួលជាជាងអ្នកទិញក្នុងករណីភាគច្រើន។ សេវាកម្មរួមមានផ្ទះបាយ ដែលមានរចនាបថបែបលោកខាងលិច ម៉ាស៊ីនត្រជាក់ និងអាងហែលទឹក។ អាផាតមិន ដែលមានសេវាកម្មច្រើនតែរួមបញ្ចូលដូចជា៖ អាងហែលទឹក កន្លែងហាត់ប្រាណ កន្លែងបោកគក់ ការសំអាត និងសន្តិសុខ ២៤ ម៉ោង។

ជាមួយនឹងខុនដូជំនាន់ថ្មីនៅតាមតំបន់សំខាន់ៗដូចជាភ្នំពេញ និងក្រុងព្រះសីហនុ ការផ្គត់ផ្គង់អាផាតមិនកំពុងកើនឡើងនៅពេលអ្នកអភិវឌ្ឍន៍ និងវិនិយោគិនស្វែងរកការជួលត្រឡប់មកវិញសម្រាប់គម្រោងដែលបានបញ្ចប់។ ការផ្គត់ផ្គង់កើនឡើងកំពុងជំរុញឱ្យអត្រាជួលសម្រាប់យូនីតទាំងនេះធ្លាក់ចុះ។

ទោះយ៉ាងណានៅពេលមានពលករបរទេសកាន់តែច្រើនចូលមកក្នុងប្រទេសកម្ពុជា តម្រូវការក៏នឹងនៅតែបន្តកើនឡើងសម្រាប់សេវាកម្មអាផាតមិន។ ទន្ទឹមនឹងនេះកម្រិតនៃការគ្រប់គ្រងអចលនទ្រព្យវិជ្ជាជីវៈកំពុងកើនឡើងនៅក្នុងទីផ្សារទាំងមូល ជាពិសេសនៅរាជធានីភ្នំពេញ ដោយផ្តល់ជូនសេវាល្អប្រសើរជាងមុនដល់អ្នកជួល។

បុរីការអភិវឌ្ឍបុរីត្រូវបានគេស្គាល់ថាជាគម្រោងលំនៅដ្ឋានបែបសហគមន៍។ ទីនេះមានការបញ្ចូលគ្នានូវវីឡា វីឡាទោល វីឡាភ្លោះ វីឡាកូនកាត់ ផ្ទះអាជីវកម្ម និងហាងលក់រាយ។ ការអភិវឌ្ឍបុរីមានច្រើនប្រភេទ និងមានតំបន់សហគមន៍ជាផ្សារលក់ទំនិញ កន្លែងបរិភោគអាហារ កន្លែងកម្សាន្ត និងកន្លែងលេងកីឡា។ ការអភិវឌ្ឍទាំងនេះមានទំនោរទៅតំបន់ជាយក្រុងព្រោះអ្នកអភិវឌ្ឍន៍មានការប្រយ័ត្នប្រយែងចំពោះតម្លៃដីធ្លី ដោយសារតែអំណាចចំណាយមានកំណត់សម្រាប់អតិថិជនទីផ្សារគោលដៅរបស់ពួកគេ។ នៅកម្ពុជា បុរីមានផ្តល់ជូនជម្រើសយ៉ាងទូលំទូលាយ ជាមួយនឹងការផ្តល់ជូនគុណភាពសំណង់ និងការគ្រប់គ្រងអចលនទ្រព្យផ្សេងៗគ្នា។

ផ្ទះបុរីគឺជាជម្រើសលំនៅដ្ឋានដ៏ប្រសើរបំផុតសម្រាប់គ្រួសារខ្មែរភាគច្រើន ដែលកំពុងស្វែងរកការវិនិយោគលើអចលនទ្រព្យថ្មីព្រោះវាផ្តល់នូវហេដ្ឋារចនាសម្ព័ន្ធពេញលេញនៅក្នុងបរិវេណ និងជាកន្លែងមានសុវត្ថិភាពសម្រាប់ការរស់នៅសម្រាប់គ្រួសារ។

មានបរទេសកាន់តែច្រើនឡើងដែលស្វែងរកផ្ទះនៅខាងក្រៅក្រុង និងបានជួលផ្ទះក្នុងបុរីជា ពិសេសអ្នកដែលមានសត្វចិញ្ចឹម ឬរស់នៅជាគ្រួសារ។ ទោះជាយ៉ាងណា តាមផ្លុវច្បាប់ជនបរទេសមិនអាចទិញផ្ទះនៅក្នុងគម្រោងបុរី ដោយសារបុរីជាអចលនទ្រព្យដែលតាំងជាប់ដី។

៣.២ ទីផ្សារអចលនទ្រព្យបច្ចុប្បន្ន

៣.២.១ លំនៅដ្ឋានតម្លៃសមរម្យ

ខុនដូCondominium projects in Cambodia have been concentrated in Phnom Penh’s city center. According to data from CBRE’s Market Outlook 2019, the surge in condominium developments began in 2014 with high (mainly foreign) demand from China, Singapore, Taiwan, Malaysia, Korea and Japan. The condominium market attracts foreign investors as it offers comparatively high rental yields between 5% and 8% made possible by Cambodia’s dollarized economy.

The projected demand for condominiums will go well into 2020 based on completed and announced projects starting in 2019. According to Knight Frank’s H1 2019 Real Estate Highlights, 6 condominium projects were completed with 16 more launched during the same period. Grade A (high-tier) condominiums still dominate both the completed and announced projects since they’re geared towards high income Cambodians and foreign investors interested in the market’s high rental yields.

At present, 61% of available condominiums are considered high-end. The growing supply of these condominiums are mostly absorbed by foreign investors, more recently the influx of Chinese expatriates, as these condominiums are mainly out of reach for most domestic buyers.

There is, however, a steady rise in Grade B (mid-tier) condominiums mainly targeted towards domestic buyers. This type of condominium is expected to grow primarily due to how expensive Grade A units are for most Cambodian families. Grade B condominiums are serving the gap in the market created by middle-class Cambodians looking for a place to live in the city or as a venture into the rental market.

The former holds more ground as middle-class Cambodians are considering residence closer or within the city’s business centres due to increasing traffic in Phnom Penh. This has been a hot topic beginning 2014 as more people come from the countryside to work in better-paying jobs. This problem is further exacerbated by the lack of a mass transport system servicing the urban centres within the capital.

Overall, the condominium sector in Phnom Penh will need to be closely watched as while the increase in supply indicates projections of demand, it does pose a risk of oversaturation that may not be adequately absorbed by high-income Cambodians, and even foreign investors/expatriates, over the long-term. Condominium prices - both in sales and rentals - will have to become competitive to both: keep the interest of foreign investors in Cambodia’s real estate market, and accommodate the growing mid-tier demand for condominium living.

សេវាកម្ម អាផាតមេនServiced apartments are apartment units that are fully-furnished and come with cleaning services a few times a week. Some serviced apartments may offer additional conveniences for tenants as a way to stay competitive in Phnom Penh’s increasing supply of this type of property. According to Knight Frank’s H1 2019 Real Estate Highlights, a total cumulative supply of 5,483 serviced apartment units were recorded in the first half of 2019 which indicates an approximate 9% year-on-year increase in supply for the same period in 2018. Knight Frank reports an occupancy rate of 74% of the total available units as of H1 2019.

This relatively high occupancy rate indicates a strong interest in this type of property as it comes fully furnished and with services that increase its quality-of-life appeal for expat living. Most of these serviced apartments are concentrated in the BKK district at 35% followed by Chamkarmon at 20%, Daun Penh at 13%, and Toul Kork at 13%. The remaining apartments are scattered throughout 7 Makara, Chroy Changvar, Sen Sok, and Mean Chey.

By contrast to condominiums, midtier serviced apartments dominate this property type at 57% share of the market, according to Knight Frank’s H1 Real Estate Highlights report. Mid-tier dominance of serviced apartments may continue for the next few years as it offers itself as an attractive alternative to increasingly more expensive condominiums.

A bulk of serviced apartments are generally for rent, and are located in commercial districts which makes it even more attractive to Phnom Penh’s growing expatriate population. Some serviced apartment blocks have reportedly been rented out by Chinese companies as staff housing due to convenience they provide.

According to CBRE Real Estate Outlook 2019, the growth in serviced apartments have attracted the attention of international brands such as The Ascott and Oakwood. Some condominium developers already operating in Cambodia are considering repositioning some components of their development projects as serviced apartments to offset lacklustre pre-sales figures of condominium units.

Knight Frank’s H1 2019 report highlights a positive outlook for the growth of this property type. Development of serviced apartments are expected to continue as over 1,300 units were identified to be in the development pipeline post 2020. Despite the increase in supply over 2018, however, prices have not dropped as the expected dip was buoyed by the influx of Chinese expatriates in the city.

បុរីBorey development in Cambodia, particularly in Phnom Penh, firstsaw interest in the 2000s. Since then, borey developers have capitalized on the growing interest for these gated and guarded communities that offer a variety of properties like Shophouses, Linked Houses, Twin Villas, Queen & King Villas, according to Knight Frank Cambodia.

Considering the rapid growth of Phnom Penh as a city, most (96%, according to Knight Frank’s H1 2019 Report) borey developments are located in the suburban districts of Phnom Penh as opposed to the concentration of condominiums/ serviced apartments within the city centre. Over 51,278 units were recorded during H1 2019 distributed over 131 borey developments.

The Mid-tier classification of boreys is anticipated to dominate the future supply of boreys at 59%, followed by Affordable at 33% and High-end occupying the remaining 8%. Boreys are mainly targeted towards domestic buyers who largely prefer this type of property as their primary residence.

According to Knight Frank, borey developers are seeing anywhere from 40% to 70% sales in their developments. Given the huge domestic demand, property developers have not shown any signs of slowing down in launching borey developments as 18 borey developments were launched in H1 2019 alone.

The pace of growth in Phnom Penh has made it virtually impossible for affordable housing options to be built within the city center. The development of borey projects at the utskirts of Phnom Penh will likely reflect on the wider real estate market. According to Knight Frank, satellite cities, complete with commercial and business districts of their own, might start to emerge as residents of boreys outside the city prefer conveniences more proximal to them as opposed to commuting towards the busy centre of the capital.

The total supply of housing, including all residential property types, amounted to 74,307 units in the first half of 2019 alone. By comparison, the total available housing units in 2018 was 76,560. Completed residential units in the first half of 2019 alone are already 97% of total residential property units produced in 2018. We could well expect that 2019 could be the biggest year for Cambodia’s residential developers yet, especially in terms of borey development.

តម្រូវការសម្រាប់លំនៅដ្ឋានដែលមានតម្លៃសមរម្យត្រូវបានទទួលស្គាល់ដោយរដ្ឋាភិបាលផងដែរ។ ក្រសួងរៀបចំដែនដីនគរូបនីយកម្ម និងសំណង់បានបញ្ជាក់ថារដ្ឋាភិបាលនឹងបន្តអនុវត្តគោលនយោបាយជាតិស្តីពីលំនៅដ្ឋានដែលគោលដៅផ្តល់នូវលំនៅដ្ឋានតម្លៃសមរម្យទៅដល់ប្រជាជនកម្ពុជាដែលមានប្រាក់ចំណូលមធ្យមកម្រិតទាប។ យន្តការមួយក្នុងចំណោមយន្តការដែលក្រសួងដែនដីកំពុងប្រើគឺការសហការជាមួយក្រសួងសេដ្ឋកិច្ ចនិងហិរញ្ញវត្ថុដើម្បីបង្កើតលំនៅដ្ឋានតម្លៃទាបតាមរយៈការលើកទឹកចិត្តផ្នែកពន្ធ សម្រាប់ទាំងអ្នកអភិវឌ្ឍន៍ និងអ្នកទិញចុងក្រោយ។ រដ្ឋាភិបាលជឿជាក់ថាតំបន់ក្រុង និងទីប្រជុំជនត្រូវការផ្ទះថ្មីចំនួន ៥៥,០០០ ខ្នងជារាល់ឆ្នាំ ដើម្បីឆ្លើយតបនឹងតម្រូវការកើនឡើង។ គេរំពឹងថានៅឆ្នាំ២០៣០ ប្រទេសកម្ពុជានឹងត្រូវការផ្ទះចំនួន ៨០០,០០០ខ្នង បន្ថែមទៀតនៅទូទាំងប្រទេស ខណៈចំនួនប្រជាជនត្រូវបានគេរំពឹងថានឹងកើនឡើងដល់ជាង ១៩ លាននាក់។

The government believes that 55,000 new homes in urban areas are necessary every year to satisfy increasing demand. It is anticipated that by 2030 Cambodia will need an additional 800,000 homes nationwide as the population is expected to grow to over 19 million.

៣.២.២ កន្លែងពាណិជ្ជកម្ម / លក់រាយ

The Cambodian sense for shopping has come a long way from the traditional hawker stands, wet markets, and shop houses. The expanding middle-class has embraced the concept of the retail mall and podiums, mainly fueled by the growth of their disposable income. The demand for more retail options has drawn the attention of international retailers, with local developers paving the way for their entry.

The total retail space available in Phnom Penh as of 2019 is 338,505 net lettable area (NLA) according to Knight Frank’s H1 2019 Real Estate Highlights. The opening of the Olympia Mall (60,000 sqm), Midtown Mall (5,000 sqm), and WB Arena (6,500 sqm) have been major contributors to the massive growth year-on-year. The same report estimates a further 109,947 sqm NLA for retail is expected to be added by the end of 2019 assuming projects are completed as scheduled.

Local developers such as Chip Mong Group and Peng Houth, according to CBRE’s Real Estate Market Outlook 2019, have launched several projects that seek to satisfy the demand for more retail options from consumers. Chip Mong Group, in particular, recently announced plans to develop 6 retail projects to open in the next 3 years.

AEON Co. Ltd., the Japanese mall developer operating two of the biggest malls in Phnom Penh, have announced the opening of the third AEON mall located in the south of Phnom Penh along Samdech Techo Hun Sen Boulevard. The 3rd AEON mall is reported to be 174,000 sqm - the size of AEON Mall 1 and 2 combined.

Retail podiums are also taking its place in Cambodia’s growing appetite for retail options. The Peak leads in the retail podium space with its combined retail and residential complex set to open sometime in 2020. Retail podiums are a relatively newer concept to the Cambodian retail market, hence, its acceptance within the wider market is still to be seen.

According to Knight Frank’s H1 2019 Real Estate Highlights, average occupancy rate in H1 2019 slid down to 80.8% - down by 8.1 points from H2 2018. The report attributes this drop to the opening of the Olympia Mall and WB Arena as it will take some time before retailers outfit their units and physically occupy their space.

The growth of commercial/retail spaces is a great indicator of a maturing economy. Both CBRE and Knight Frank report a positive outlook for the retail sector of the real estate market in Cambodia. According to Knight Frank, the retail sector is set to expand by an additional 505,521 sqm of NLA which will bring the total stock to 844,026 sqm - a 216% increase by 2021. This is assuming that all announced projects meet their target operational dates. While retail space will continue to expand, CBRE’s Real Estate Outlook 2019 cautions high-end brands who may find it difficult to meet retail targets if prices are set based on developed markets.

The growth of the retail sector offers an interesting alternate point-of-view of the Cambodian economy as it takes into account the willingness-to-spend of the average Cambodian on a daily basis as opposed to “one-time, big-time” purchases like houses and condominiums.

៣.២.៣ ការិយាល័យ

Office spaces in Cambodia have grown in stock since projects began in 2012. According to Knight Frank’s H1 Real Estate Highlights 2019, the most recent stock of office spaces in Phnom Penh increased by 23% from 2018 and now amounts to 463,701 sqm. This is an aggregate amount of the graded offices available in Phnom Penh, specifically, Grade A, B, and C.

As of H1 2019, Knight Frank reports 45% of currently available office space is classified as Grade C, followed by Grade B officers at 43% and Grade A offices occupying the remaining 12%. The report projects a 130% (595,469 sqm NLA) increase in office space, amounting to 1,059,170 sqm NLA by 2021, of which, 75% of expected new office stock will be Grade A, while 24% will be Grade B and at 1% will be Grade C. The trend clearly shows a sharp increase in projected demand for high-end offices in Cambodia and an upcoming shrinking supply of mid- and low-tier offices.

Strata-title offices have recently been introduced to the market, specifically from newer office buildings. These strata-title offices virtually operate the same as strata titled condominiums except for the type of tenants these spaces accommodate. Companies who occupy conventional centrally owned office buildings normally deal with one central management for the building. On the other hand, companies who occupy multiple strata-titled units may have to deal with the different owners of spaces they are using.

Strata-titles are emerging as a new form of property investment as the market for strata-titled condominiums hit equilibrium. As strata-titled offices are new to the office real estate sector, their value in the wider market is yet to be determined.

Office spaces in Phnom Penh are still primarily located in Daun Penh at 32%. Followed by Chamkarmon at 25%, 7 Makara at 17%, and Boeng Keng Kong at 15%. The remaining office spaces of mostly Grade C buildings are distributed in Toul Kork, Sen Sok, Meanchey, and Chroy Changvar.

3.2.4 Consumer Sentiment Survey 2019

Considering the growth Cambodia is experiencing on a macroeconomic level, Realestate. com.kh polled consumer perception of the real estate market through the Consumer Sentiment Survey 2019 which surveyed over 2,000 respondents. These respondents’ demographics vary but most are Cambodian at 73.4%.

The remaining 26.6% are made up of foreigners: Chinese, Australian, American, French and many other Western and Asian expats. While the sample size is relatively small, the respondents were primarily people who showed interest in real estate by browsing through Realestate.com.kh.

Survey respondents were asked about their age. The survey found 37.5% of respondents were aged 21 to 30 which suggests an interest of young people in Cambodian real estate. Closely behind at 35.3% were respondents aged between 31 to 40 years old, which would be generally considered people with careers and some savings to speak of. Far behind at 7.2% are respondents aged from 51-60. More senior respondents, aged 60 and beyond composed 5.6% of the survey. Last 2.8% came from respondents aged 20 years and below.

Of the 2,000 surveyed respondents, 46% indicated that they live with their partner or spouse. These are followed by respondents living with their family at 22.6%, and those living alone number at the same 22.6%. The remaining either share a space with friends or prefer not to specify. Additionally, 51% of respondents say they are homeowners in Cambodia, a rise from 48% in 2018.

A 20% segment indicated they’re currently paying off their loans while 19% says they’re renting but have plans to buy/own their own property. The remaining 12% says they’re renting without plans of buying their own property.

អំណាចទិញThe survey also asked respondents for their monthly income to get a rough estimate of their purchasing power. Our 2019 survey shows a noteworthy increase in participation from respondents earning less than $500 a month as this segment increased from 16% to 21% this year. This could be attributed to young people working part-time or those working in entry level positions showing interest in real estate by browsing Realestate.com.kh.

Data also shows increased participation from those earning $500 to $1000 as their monthly income as they increased 5 points to make up 21.5% of respondents this 2019. This income bracket is likely those who can afford to rent and/or are more eligible to get a loan from a bank for their very first property purchase.

Participants earning $1,001 to $2,000 a month remained static at 19% of total survey respondents. Respondents earning $2,001 to $3,000 a month slightly increased to 13.5% this year.

On the higher end of the income spectrum, respondents earning $3,001 to $4,000 slightly decreased to 5.5%. This can simply be attributed to increased participation from the lower income bracket resulting in a bigger share of total survey respondents.

The same goes for those earning $4,001 to $5,000 sliding down to a fl at 5%. Participants earning $5,001 to $10,000 decreased from 9% to 7% this 2019 survey. While the ultrahigh income at $10,000 or more per month decreased from 9% to 7.5%.

The Consumer Sentiment Survey uses this data to get a gauge of how much each income bracket vis-a-vis data collected on willingness to spend on property in Cambodia.

For those earning less than $500 a month, 76% of respondents say they’re willing to spend less than $50,000 on property. 13%, on the other hand, are willing to spend a bit more between $50,001 to $75,000. About 5% are willing to spend $75,001 to $100,000. Less than 5% of remaining respondents in this income bracket are willing to spend more than $100,000.

For those earning $501 to $1,000 per month, 51% of respondents are willing to spend less than $50,000 for property. Another 32% are willing to spend more, between $50,001 to $75,000. About 9% of respondents would be willing to spend $75,001 to $100,000. While only less than 10% are willing to spend over $100,000.

For those earning $1,001 to $2,000 per month, 40% of respondents are willing to spend less than $50,000 for property. Another 36% of this bracket are willing to spend $50,001 to $75,000. About 11% are willing to spend $75,001 to $100,000 on property. While only 10% indicated a willingness-to-spend at $100,001 to $200,000. Only less than 3% of this income bracket are willing to spend over $200,000.

For those earning $2,001 to $3,000 per month, only 22% are willing to spend on property less than $50,000. A majority of this income bracket, at 31%, are willing to spend $50,001 to $75,000. Another 24% are willing to spend higher at $75,001 to $100,000. Around 17% of respondents are willing to spend $100,001 to $200,000 on property. While only about 5% are willing to spend on property over $200,000.

For those earning $3,001 to $4,000 per month, only 11% would consider spending on property costing less than $50,000. A 24.5% portion of respondents would spend $50,001 to $75,000. Another 24% of respondents would spend $75,001 to $100,000 on property. While another 24.5% would be willing to spend on property costing $100,001 to $200,000. Only 11% of respondents in this bracket said they are willing to spend on property costing $200,001 to $300,000. Less than 1% indicated they would spend over $300,000.

For those earning $4,001 to $5,000, only 11% would spend less than $50,000 on property. About 22% indicated they would spend anywhere between $50,001 to $75,000. Another 20% said they would spend $75,001 to $100,000 on property. Most respondents in this income bracket, at 35%, said they would spend $100,001 to $200,000 on property. While 9% would spend $200,001 to $300,000. Only about 2% said they would spend over $300,000.

For those earning $5,001 to $10,000, about 12% said they would spend less than $50,000 on property. Another 11% said they would spend $50,001 to $75,000. Most respondents in this bracket, at 31%, said they are willing to spend $75,001 to $100,000. About 24% of respondents indicated they would spend $100,001 to $200,000 on property - this is an interesting downward turn for willingness-to-spend since the previous (comparatively lower income bracket) would be willing to spend more on property.

Another 12% of respondents said they would spend $200,001 to $300,0000 on property. While 9% said they would spend over $300,000.

For the ultra-high income at over $10,000 per month, about 9% said they would spend on property less than $50,000. Another 9% said they would spend anywhere from $50,001 to $75,000. 3% of respondents in this income bracket said they would spend between $75,001 to $100,000.

Majority of respondents, at 30%, said they would spend $100,001 - $200,000 on property. 16% of respondents said they would be willing to spend $200,001 to $300,000 on a property purchase. While 23% of respondents in this high-income bracket said they would be willing to spend over $300,000.

Willingness-to-spend of respondents do not vastly deviate from assumptions that higher incomes lead to more expensive preferences. The trend also suggests that properties hovering around the $100,000 price tag covers most of the market segmented by income brackets.

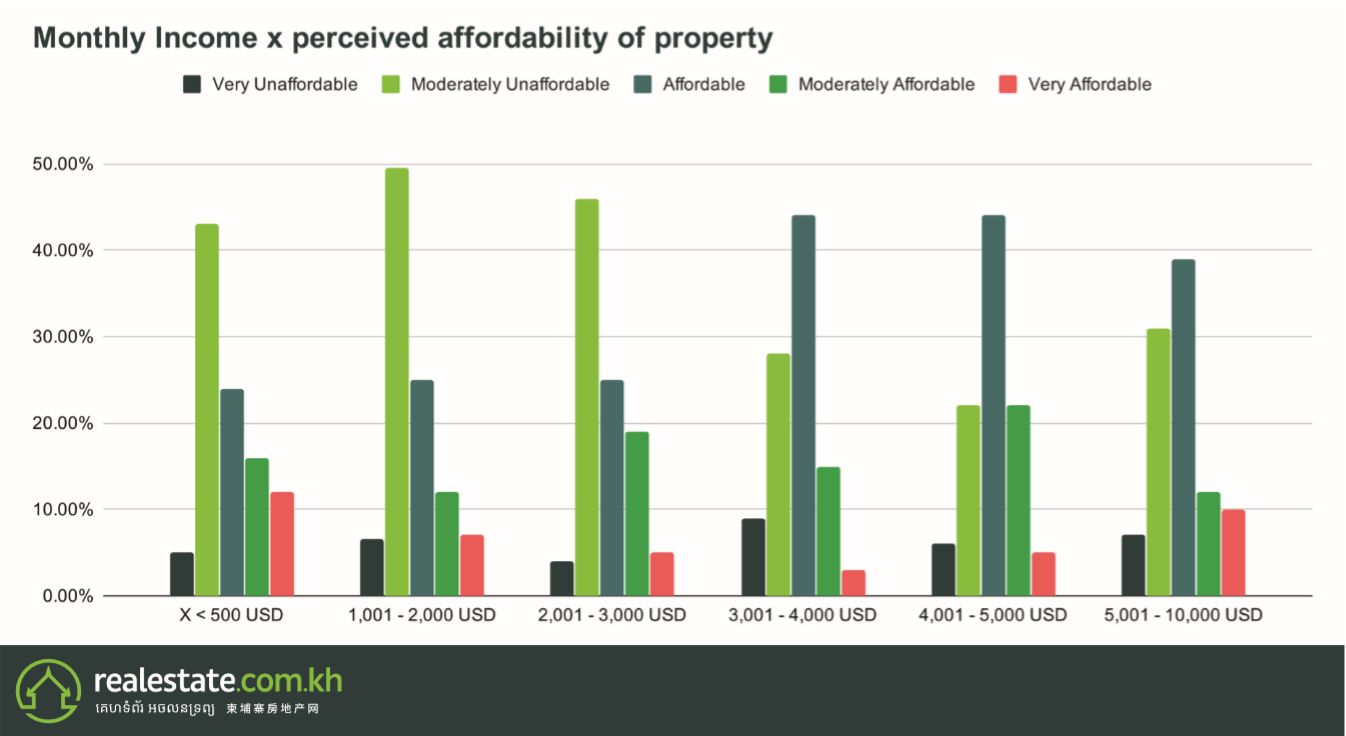

តម្លៃសមរម្យIn order to get a gauge of perceived affordability, the Consumer Sentiment Survey 2019 gave respondents a selection of their perceived affordability of housing prices in Cambodia. The selection asked them whether they found prices to be: Very Affordable, Moderately Affordable, Affordable, Moderately Unaffordable, and Very Unaffordable.

The survey found that 42% of total respondents found housing prices in Cambodia to be Moderately Unaffordable. While those who perceive housing prices to be affordable number at 29% of total respondents.

Those who found housing to be Moderately Affordable were 14% of respondents. On the extremes, 9% of total respondents found housing to be Very Affordable, while on the opposite end, 6% of respondents found housing to be Very Unaffordable.

The Consumer Sentiment Survey breaks down this result further by filtering perceived affordability through the perspective of each income bracket.

The survey found that 43% of respondents earning less than $500 per month found housing to be moderately unaffordable in Cambodia. While 24% of respondents in this income bracket found housing to be Affordable. 27% of respondents in this income bracket found housing to be Moderate to Very Affordable. Only 5% of respondents found housing to be Very Unaffordable.

For the $501 to $1,000 income bracket, 49.5% of respondents find housing to be Moderately Unafforable. 25% of respondents in this income bracket found housing to be Affordable. About 19% of respondents find housing to be Moderate to Very Affordable. About 6.5% of respondents found housing to be Very Unaffordable.

For the $1,001 to $2,000 income bracket, 50% of respondents find housing to be Moderately Unaffordable. Another 25% of respondents perceive housing to be Affordable. About 14% of respondents find housing to be Moderately Affordable. 5% of respondents see housing to be Very Affordable. While 6% of respondents in this income bracket see housing prices to be Very Unaffordable.

For the $2,001 to $3,000 income bracket, 46% of respondents find housing to be Moderately Unaffordable. Another 25% of respondents find housing to be Affordable. Around 19% of respondents in this income bracket find housing to be Moderately Affordable. On the extremes, 5% housing to be Very Affordable, while 4% consider housing to be Very Unaffordable.

For the $3,001 to $4,000 income bracket, we see a change in perception as 44% of respondents find housing to be Affordable. While 28% of respondents here find housing to be Moderately Unaffordable. 15% of respondents in this income bracket find housing to be Moderately Affordable. Strangely enough, 9% of respondents in this income bracket find housing to be Very Unaffordable. This stands in contrast to the 3% who find housing to be Very Affordable.

For the $4,001 to $5,000 income bracket, 44% of respondents find housing to be Affordable. This is followed by 22% of respondents who find housing to be Moderately Affordable. While another 22% consider housing to be Moderately Unaffordable. On the extremes, 6% find housing to be Very Unaffordable, while 5% find it Very Affordable. There seems to be an even spread from the middle-outward in this income bracket.

For the highest income bracket of $5,001 to $10,000, 39% of respondents find housing to be Affordable. This is followed by 31% of respondents saying housing is Moderately Unaffordable. 12% of respondents say they find housing Moderately Affordable and another 10% finding it Very Affordable. 7% of respondents in this high income bracket say housing is Very Unaffordable.

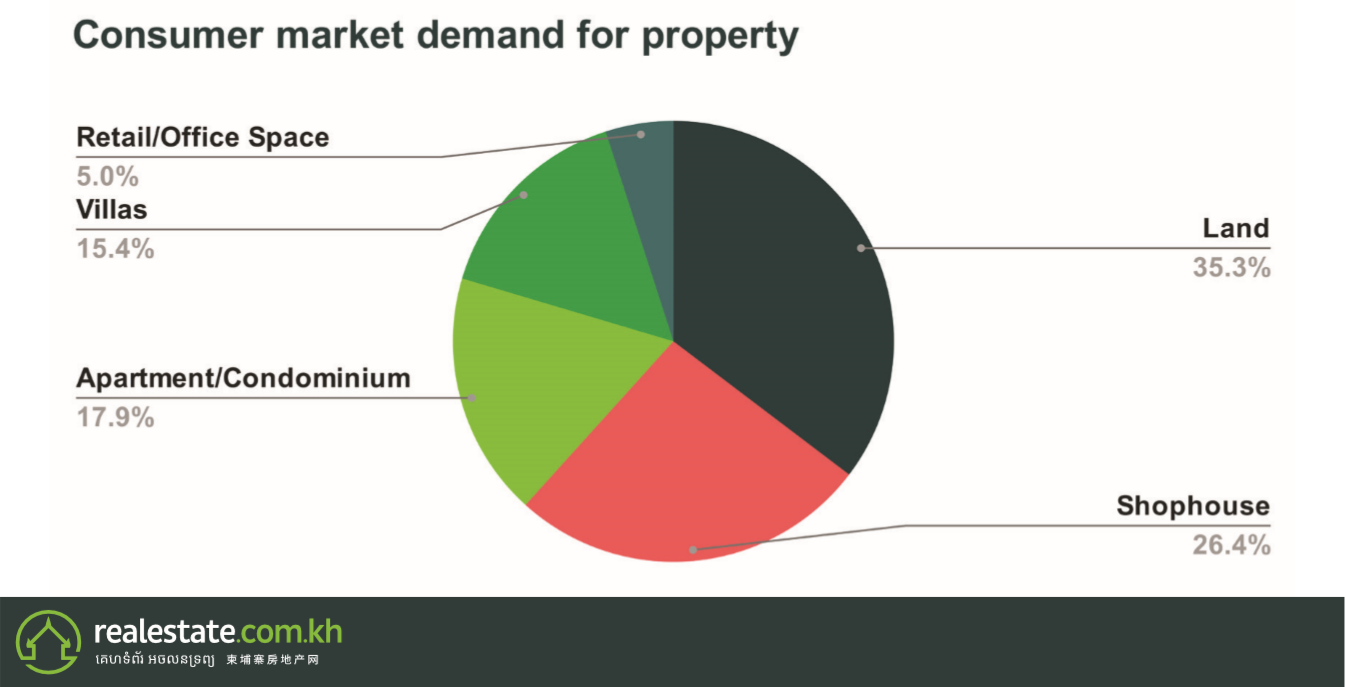

តម្រូវការDemand for property remains high within the Kingdom of Cambodia. The expansion of the middle class, their disposable income, and the increase in property prices have certainly piqued the interest of investors, both local and foreign. Hence, property developers have sought to meet the varying demands of Cambodia’s continuously expanding real estate markets. The Consumer Sentiment Survey 2019 acquired an estimated measure of demand by asking respondents what kind of property they are planning to purchase.

Out of over 2,000 respondents, 35.5% of respondents indicated they would prefer to buy bare plots of land. Following this segment are those interested in shophouses at 26.5% of respondents. Another 18% of respondents say they are interested in buying an apartment. This is followed by 15.5% of respondents looking to buy villas. The remaining 5% look to invest in retail/office space.

The Consumer Sentiment Survey 2019 sought to acquire an estimate of demand by asking respondents whether they’re planning to buy property in the next 12 months. About 78% of respondents indicated they would be purchasing property in the following year, while only 22% said they are not interested in purchasing property.

The increase of property prices are not lost on the wider market as well. Hence, the Consumer Sentiment Survey 2019 also asked respondents for what purpose they were buying the property for. Only 35% of respondents said they would be buying property to live in, as opposed to 65% who planned on treating it as an investment property/venture.

ទីតាំងនិងប្រភេទអចលនទ្រព្យWhen looking at the three main Cambodian urban centres, Phnom Penh, Siem Reap and Sihanoukville, the majority of respondents indicated that they were looking to purchase property in the capital. 76% of respondents preferred Phnom Penh, followed by 8% of respondents who were interested in property in Siem Reap and just a little over 3% who noted shopping for property in Sihanoukville. Interest in Kampot overtook interest in Sihanoukville at a little over 5%.

The nationwide ban on online gambling in August 2019 severely slashed property prices in Sihanoukville. Considering that most respondents consider buying property for investment properties, the coastal town’s investment appeal expectedly plummeted. Industry insiders agree that it would take some time for the city’s real estate market to pick up.

Since a majority of property hunters expressed interest in property in the capital, the Consumer Sentiment Survey 2019 asked respondents which district in Phnom Penh they were mostly likely to buy property in.

15% of survey respondents indicated an interest in buying property in Sen Sok. This area is populated with boreys and even more borey developments, making it a somewhat unsurprising choice for most homebuyers. This is where AEON 2 mall is located, arguably the biggest shopping mall in Phnom Penh to date.

Behind it is Chroy Changvar at 12%, a developing satellite city filled with condominiums, apartments, and some major borey developments as well. Toul Kork comes in 3rd at 8% of respondents expressing interest in buying property in the district.

This area is also a center of borey developments in Phnom Penh. Following this is the district of Chamkarmon at 8% - another area populated by condominiums, apartments, restaurants, cafes, shopping centers and markets.

Only 5% of respondents are interested in looking for property in Daun Penh, which is not surprising as it is the primary business district of Phnom Penh, and consequently, an expensive area to purchase property in.

The interest of most respondents seems to be stretching towards the outskirts of the city and appears to be leading towards a preference for developments there. The Consumer Sentiment Survey 2019 also asked respondents for the kind of property they are interested in.

Survey data shows an almost even interest in borey property at 29% and an independent house/villa at 28% - the difference being a few dozen respondents. Behind these two are those looking to buy a condo in a new development at 22% and those looking to buy bare plots of land at 21% of respondents.

- សេចក្តីណែនាំ

- ផលប៉ះពាល់សេដ្ឋកិច្ច ១៩ Covid ១៩

- ប្រទេសកម្ពុជា, សេដ្ឋកិច្ចរីកមច្រើនថ្មីចុងក្រោយ: ឱកាសទាំងមូល

- ១. អំពីប្រទេសកម្ពុជា

- ២. យន្តការ កម្មសិទ្ធិអចលនទ្រព្យ របស់ជនបរទេស

- ៣. ទិដ្ឋភាពវិស័យអចលនទ្រព្យនៅកម្ពុជា

ចំនូលចិត្ត

សូមបំពេញព័ត៌មានផ្ទាល់ខ្លួនមុនពេលរក្សាទុកអ្វីដែលអ្នកពេញចិត្ត។ បើកនៅលើការកំណត់ប្រូហ្វាល់.